Protect Your Wealth, Achieve Peace,

Ignite Your Purpose

Tailored Family Office solutions for visionary entrepreneurs and business owners—designed to safeguard your wealth, provide financial clarity, and empower your purpose.

Our Approach

Ark Transforms Traditional Wealth Management into the Family Office for Entrepreneurs and Business Owners.

We help you organize and optimize your financial life, safeguard wealth, enhance net worth through innovative tax strategies, and support the growth of your businesses and assets. Our Family Office solutions simplify complexity so you can focus on what matters most. While driving meaningful change and pursuing financial independence, we provide the clarity and confidence to achieve your goals and realize your purpose.

David Bull, CEO

Ark Financial

Identifying Your Needs (The 3 Ps)

Think Bigger. Plan Smarter. Live Abundantly.

We help entrepreneurial families align their wealth, business, and legacy through the balance of Protection, Peace, and Purpose.

Protection

Safeguarding your assets, minimizing risks, and ensuring long-term financial stability for you and your family.

Peace

Achieving peace of mind through expert knowledge, alignment, and a trusted community—empowering your family with clarity and confidence.

Purpose

Aligning your finances, values, and vision to create meaningful impact and live abundantly.

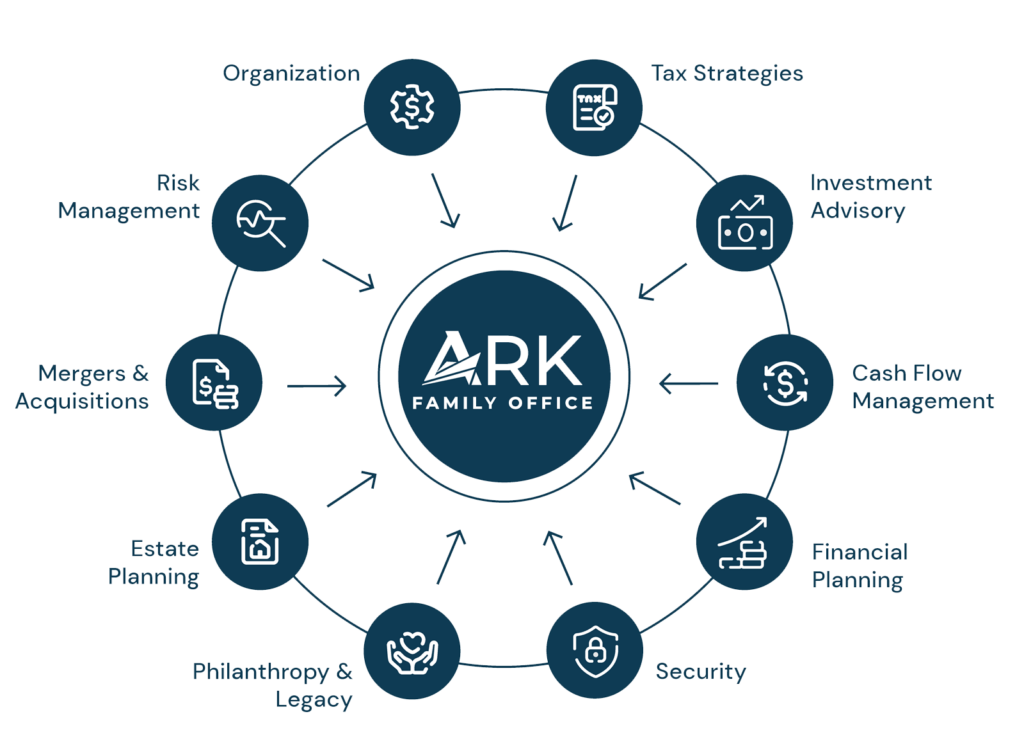

Our Family Office Operating System

Tailored Strategies for Your Family Office

At the core of our service is the Ark Family Office Captain—a dedicated advisor who ensures seamless integration of all components, providing a unified approach to your financial growth, protection, and legacy.

Ark’s integrated Family Office approach simplifies your financial life by uniting every aspect—wealth management, tax strategies, estate planning, risk management, and more—under one roof. With everything seamlessly connected, you gain the ability to make swift, informed decisions without the delays and complications of juggling multiple advisors. Our cohesive, all-in-one plan adapts quickly to your evolving needs, ensuring your financial strategy remains agile and always aligned with your goals.

Every solution we provide is tailored to your unique needs, goals, and values. From protecting your assets and planning for future generations to creating a philanthropic legacy, we ensure every component works seamlessly together—giving you clarity, peace of mind, and the freedom to focus on what matters most.

Benefits of the Family Office

Beyond Traditional Planning: Ark’s Family Office Advantage

Traditional financial planning often lacks cohesion—fragmented advice and inconsistent touchpoints fail to anticipate change, reacting only after challenges arise. We take a proactive, goal-driven approach that aligns your priorities with tailored strategies to achieve clarity, optimize net worth, and create a lasting impact.

Transform your aspirations into achievements. Cultivate powerful habits in goal-setting, both short-term and long-term, and amplify your success with precision tools. Utilize top-notch processes, centralized dashboards, and a network of aligned advisors to turn your dreams into reality more effectively. It’s about making goal attainment not just a hope, but a habit.

Your family’s finances, perfectly orchestrated. That’s the power of a family office operating system—transforming chaos into harmony. It’s about setting a rhythm, crafting systems, and aligning strategies. We gather the best advisors to ensure seamless collaboration. No detail is overlooked, no opportunity missed. This is financial orchestration at its finest, where every move is calculated, and every asset is aligned for maximum impact.

Imagine turbocharging your net worth. That’s what happens when you blend smart entity design with cunning tax strategies and ironclad wealth and cash flow management. This isn’t just saving—it’s strategic wealth building. Our holistic approach ensures every dollar serves a purpose, boosting your family’s financial strength. Welcome to the art of optimized wealth accumulation.

Unlock financial freedom with disciplined cash flow management. By integrating sound planning and rigorous accountability into your financial strategy, you create a robust system that simplifies every decision about deploying your resources. This approach not only enhances your lifestyle but also empowers your investment activities, leaving you with greater peace of mind and unwavering confidence in your financial future.

Master the art of legacy building with the family office operating system. As you adopt and implement its best practices, you’re not just enhancing your peace and wealth; you’re crafting a knowledge base, team, and systems designed to be passed down. Create a lasting legacy that benefits your loved ones and future generations, ensuring continuity and prosperity.

What Clients Say About Ark Financial

Discover how businesses like yours can transform by increasing net worth, reducing costs and taxes, and freeing you from daily financial management—giving you more time to focus on what brings you passion and joy.

Tap a thumbnail below to play a short testimonial video.

Austin Netzley

Jim Brown

Tony & Kristin Klink

Founder, 2X Coaching

Owner, Speed Auto Group

Owners, M45 Automotive

The above testimonials are current clients of Ark Financial. They did not receive compensation, and there are no conflicts of interest in these client endorsements.

Goals of the Family Office

Overcoming Financial Challenges

High taxes, disorganization, lack of strategic leadership, and poor advisory teams are just a few of the hurdles entrepreneurs face. Our services address these issues, providing solutions that bring clarity and efficiency to your financial management.

-

Comprehensive wealth-building strategies

-

Tax-efficient approaches

-

Precise financial roadmaps

-

Maximized financial success

How the Family Office Works

Ark's Family Office Operating System

The Ark Family Office includes various experts in investment strategies, tax strategies, estate planning, succession planning, business law and more, all coordinated through your dedicated Ark Family Office Captain — ensuring your financial world is not only organized but thriving. With Ark, you become our top priority. As committed fiduciaries, we operate on a 100% flat fee-based model, prioritizing your best interests with transparency and integrity. Together, let's build a legacy that lasts.

Tangible results shared here

Discover how our financial expertise transformed businesses like yours, delivering exceptional results and growth.

Helped navigate regulatory challenges. Valued advisors for strategic financial decisions.

Frederic Hill

Founder & CEO

Increase in customer growth rate

Stellar support in navigating market complexities. Trusted partners for financial growth.

Safaa Sampson

Account Executive

Saved in operational costs

Innovative solutions tailored to our needs. A reliable partner for our financial excellence.

Brendan Buck

Business Manager

Increase in company revenue

Help center

Got a question?

Get your answer

Quick answers to questions you may have. Can't find what you're looking for? Get in touch with us.

Our consulting optimizes strategies for sustainable growth and improved financial performance.